Best Forex Liquidity Providers

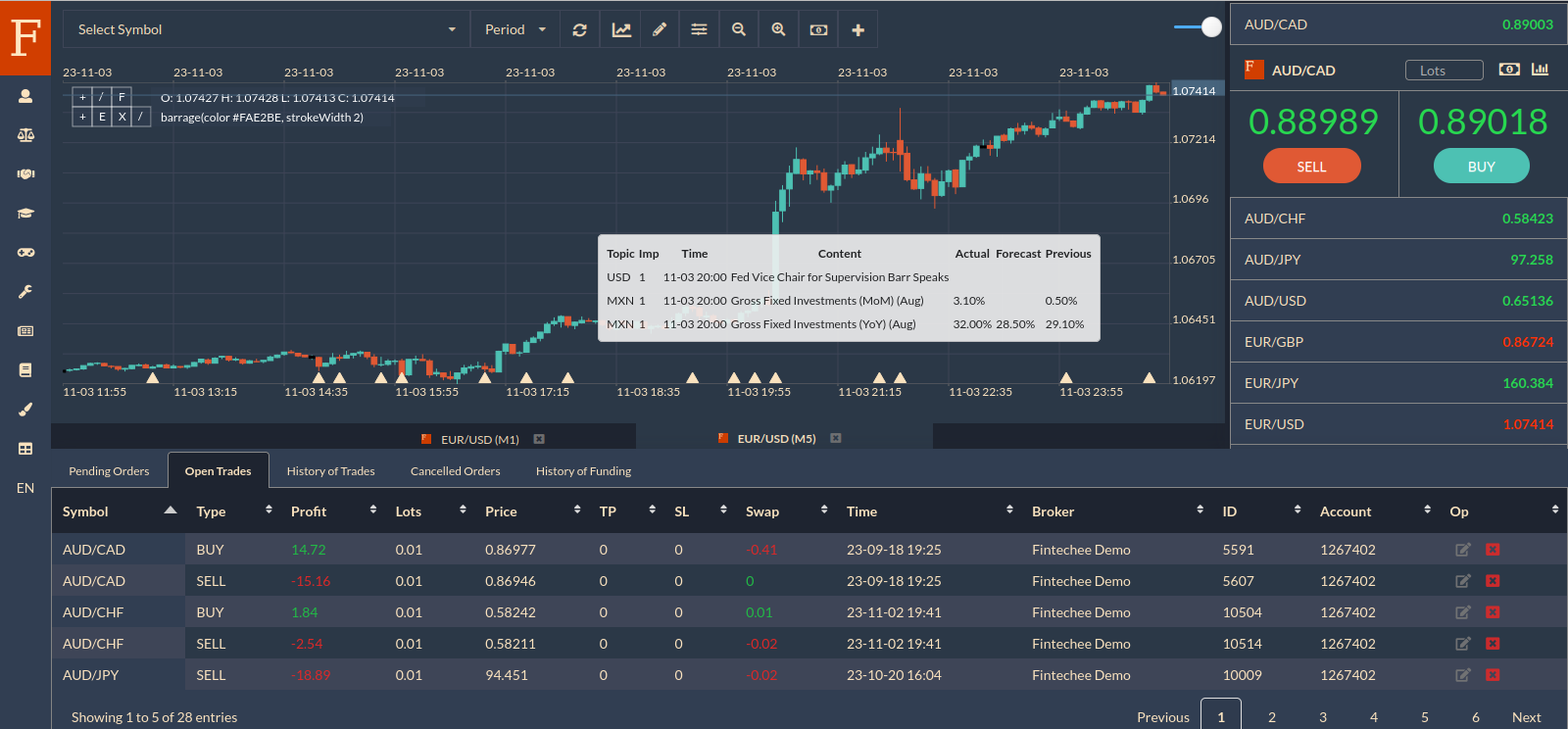

20+ Liquidity Providers collaborate with Fintechee, allowing brokers and White Labels to establish connections through the FIX API connectivity offered by our FIX API Trading Platform.

A liquidity provider refers to an authorized participant approved for investment bank business and investment trading business. They should be a settlement member of the exchange, having signed a liquidity provision contract with collective investment institutions.

Overview

We have established partnerships with over 20 liquidity providers, specifically Forex liquidity providers. Extensive testing has been conducted to ensure connectivity with each one. Funds Management Institutions have the opportunity to create a new broker by integrating their liquidity through our FIX API trading platform.

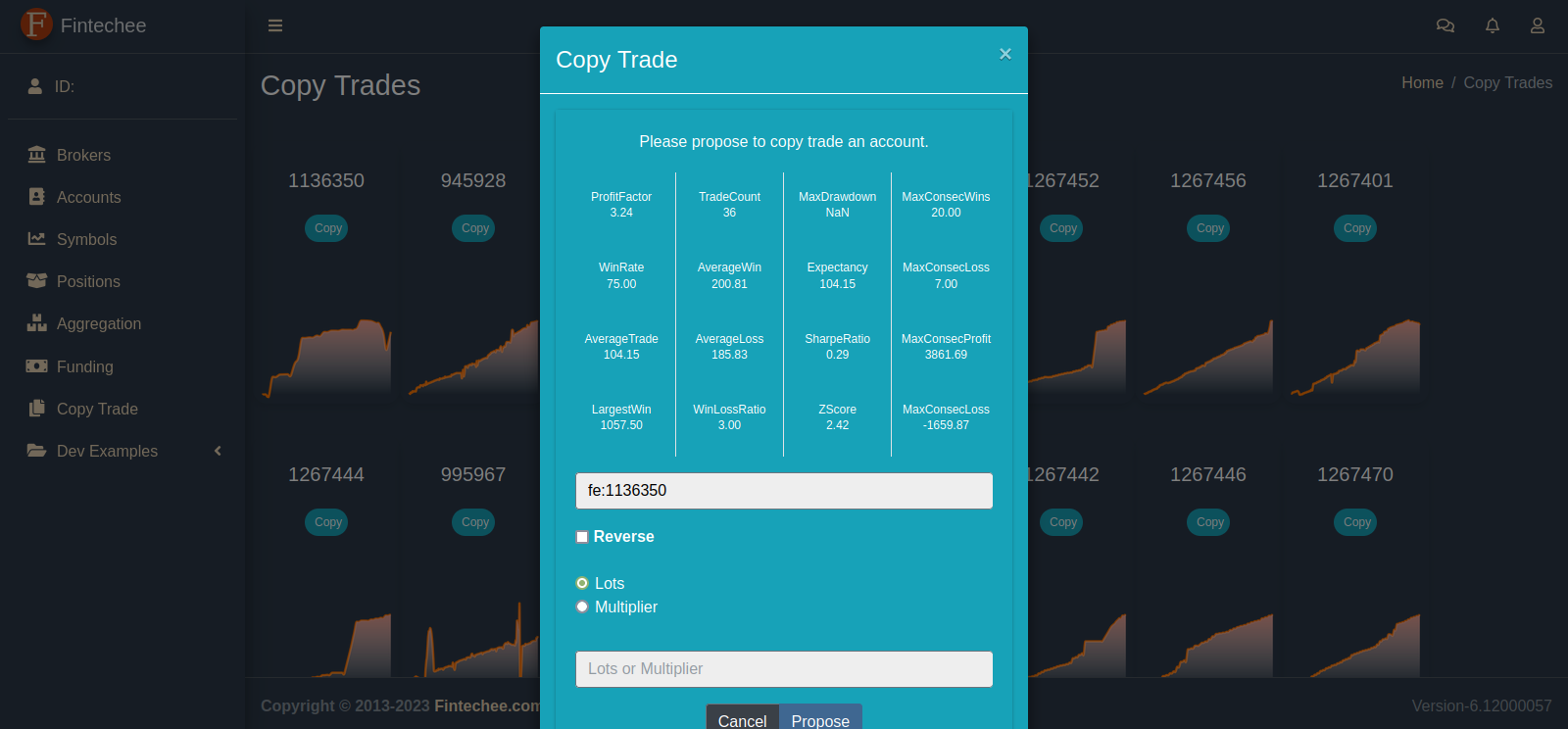

Individual Traders benefit from Trading Arbitrage, while Institutional Brokers gain advantages from the Price Aggregator.

For details on trading arbitrage, please refer to our other articles: Forex Trading Strategies, Algorithms for Trading, Tutorial for Forex Trading.

Institutional Brokers seeking an Aggregation Engine can explore our articles on Price Aggregator and FIX API Trading Platform.

For those interested in creating a new broker, please refer to our article: Forex Broker White Label, Cryptocurrency Broker White Label.

Below is a list of the Liquidity Providers we primarily cooperate with. Feel free to explore their information.

FXCM Markets

At FXCM, they strive to give you the best trading experience. They offer access to the global forex trading market, with intuitive platform options, including their award-winning Trading Station. They also provide forex education, so whether you’re just getting started in the exciting world of forex trading, or you just want to sharpen the trading tools you’ve developed over the years, they’re here to help. Their customer service team, one of the best in the industry, is available 24/5, wherever you are in the world.

LMAX Liquidity Privider

LMAX Liquidity Privider(LMAX Exchange Group) is a global, high-growth, award-winning financial technology company.

They operate one global marketplace for FX – enabling transparency, open access and a level playing field for all market participants.

One of the fastest growing financial technology companies in the UK, they have a solid presence and exchange infrastructure in all major FX markets around the world, including Europe, North America and Asia-Pacific.

Their unique vision for global FX trading is transforming the world’s largest financial market through transparent, fair, precise and consistent execution.

ATC Brokers

ATC BROKERS LTD. is a premier brokerage firm providing online trading solutions within the foreign exchange industry to clients ranging from retail to institutional traders. They believe that the foreign exchange market should be transparent and unbiased for all market participants and with that vision, they have established a pure agency model to provide their clients with services that are free of manipulation.

ATC BROKERS LTD. is established in the Cayman Islands and is regulated by the Cayman Islands Monetary Authority (CIMA). CIMA aims to protect consumers by placing rules and regulations to set high standards and protocols for firms to conduct their business within the financial industry.

Scope Markets

At Scope Markets they are licensed by the International Financial Services Commission Licence numbers IFSC/60/373/TS/18 Trading in financial & commodity-based derivative instruments & other securities and IFSC/60/373/BCA/18 Brokerage, consultancy, advisory services in trading in securities. They connect their clients using market leading technology and top-tier Forex liquidity providers.

Their mission is to offer bespoke services to their global partners as they understand that institutional traders have bespoke requirements to meet their local trading requirements.

The Scope Markets front office is operated 24/5 by a highly skilled team of trading professionals covering forex, precious metals and futures. The team understands the markets and, more importantly, understands that prompt and knowledgeable service is critical. Their deep relationships with both technology companies and Forex liquidity providers means they can offer tight spreads, market depth and speed of execution at competitive pricing to help grow your business.

Exante Crypto

Minimum risks and maximum profit when investing in cryptocurrencies with EXANTE Crypto. Their crypto funds allow for a one-click purchase of bitcoin and 15 most popular altcoins including Ethereum, Litecoin, Monero and Ripple from a single trading account. The funds’ shares are tied to the cryptocurrencies and change synchronically. With EXANTE Crypto you don’t need to worry about staying legal while trading and storing digital assets.

EXANTE XAI Fund is based on the first altcoin index XAI, which contains the leading altcoins by the market capitalization. XAI Fund enables secure, legal and tax-friendly investing in the most promising alternate cryptocurrencies right from your brokerage account.

Founded in 2012, EXANTE Crypto Bitcoin Fund is the most successful hedge fund in history, according to Bloomberg, with profit of more than 70,000% since its inception. Trade fund units just like ordinary shares – in one click right from EXANTE Crypto trading terminal. The funds’ shares are tied to bitcoin prices on the world’s leading exchanges and get recalculated several times per second.

Advanced Markets

Advanced Markets recognizes the importance of having a robust and non-latent technology infrastructure, one that caters to the needs of all institutional FX market participants, from banks and fund managers through to retail brokers and aggregators. Their platform offerings, and their underlying supporting technology, have been developed with one common goal, to facilitate Direct Market Access (DMA) via GUI, Bridge and/or FIX API.

By delivering anonymous, low-latency access to multi-bank, multi-asset liquidity, Advanced Markets presents a compelling alternative to the single and multi-bank RFQ and ECN models currently available to institutional traders. The Advanced Markets model takes the competitive, multi-bank elements of RFQ platforms and combines them with the low latency transparency and anonymity of ECNs servicing traders seeking consistent, interbank liquidity powered by robust, real-time market data. Recent refinements, such as the FOX – Full Order eXecution block order trading mechanism, are gaining the attention of hedge funds, asset managers, commodity trading advisors (CTAs) and corporate treasuries.

CMC Markets Institutional

CMC Markets Institutional is a leading provider of liquidity solutions, alongside the accompanying risk management and back office reporting tools as used by many banks, brokerages, funds and dealing desks across the globe. Established in 1989, headquartered in London and listed on the London Stock Exchange, CMC Markets also has offices in many of the world’s leading financial centres. The comprehensive CMC Liquidity Provider Services product suite provides access to deep levels of liquidity across multiple asset classes. The Prime FX offering caters to every FX trading need from a single flexible venue. It delivers direct access to institutional market liquidity provider Forex, competitive prices and more than 60 spot FX and bullion types. CMC Prime Derivatives provides an institutional trading solution with over 9000 global single stock CFDs, advance order management and low latency access to multiple pools of displayed and non-displayed liquidity providers. Finally, API Direct affords access to consistent pricing and market depth across over 400 different instruments in a package that can be quickly integrated to a counterparty’s own platform through a standard FIX API. Their flexible approach means that clients can connect to their liquidity either by using proprietary trading platforms, or via third party technology. Comprehensive back-office reporting tools are also provided, including the innovative CMC Vision platform. This is their proprietary post-trade suite of tools, deliverable via GUI or API. Whether it’s for regulatory reporting, performance analysis or risk auditing, their service delivers your data when and how you need it. From a single view, counterparties can monitor positions and margin utilisation, generate automated end of day trading extracts, view corporate action data and integrate real time account data via an API. CMC Markets is regulated in multiple jurisdictions, under the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia and Monetary Authority of Singapore (MAS) in Singapore, ensuring the company can fully comply with the needs of its global client base.

B2Broker

Liquidity is important for all tradable assets including cryptocurrencies and traders need to have transactions completed as quickly and as cost effectively as possible. The cryptocurrency market is an emerging asset class on the global arena with a growing adoption of crypto by both retail and institutional investors. CFDs are a convenient way of trading cryptocurrencies. B2Broker offers an incomparable Crypto CFD solution aggregating cryptocurrency exchanges, non-bank liquidity providers, cryptocurrency brokers, OTC orders of institutional clients, hedge funds and thousands of client-broker orders to create the deepest liquidity pool in the industry to meet all our client’s needs.

B2Broker offers direct market access to major Tier-1 FX liquidity venues, empowering your business with incomparable levels of technology, the deepest liquidity pool, speed of execution and professional support with full transparency and trading anonymity at ultra-competitive trading costs. With our liquidity solutions, we are able to provide financial institutions highly developed liquidity access, infrastructure and connectivity choices necessary to handle even the most complex HFT systems. Using our expertise and technology, we deliver customized liquidity solutions tailored to our clients’ exact execution needs.

Swissquote

As a regulated and listed Swiss Bank (SQN), they guarantee the highest level of security and compliance for their partners. They work with their partners to build a solution, based on the understanding of your core business, to ensure the best results for you and your clients.

GMI Markets

GMI professional trading platforms contain a variety of cutting edge functions. You can easily access to their deep liquidity pool and obtain bespoke price feeds, which support multiple API connectivity options. Their liquidity depth reached 10+ levels deep, with up to 50 million contract size per click on certain instruments.

GMI offers a win-win best-in-class Introducing Broker program. Being a B2B broker only, they don’t compete with their IBs for business, they provide them with wide range of reporting tools, super flexible trading terms, and highest rebates in the industry.

Price Markets

Price Markets is a leading provider of FX Prime Brokerage and Infrastructure services to the Professional trading community. The business’s success has been driven by its dynamic approach to the industry, a model that has allowed the business to grow rapidly since the launch in 2013.

TopFX

TopFX combines aggregated, DMA, Tier-1 liquidity with ultra-low latency connectivity to deliver highly costumisable liquidity solutions to brokers, investment firms, hedge funds, proprietary trading firms and other institutional clients.